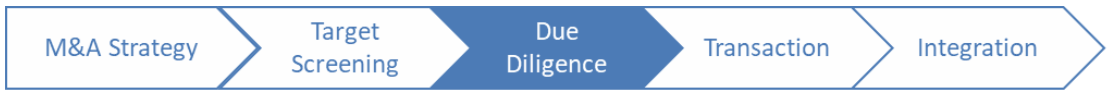

M&A Operational Due Diligence

Purpose: Fully understand the supply chain logistics capabilities of an acquisition target and risks.

M&A operational due diligence is a critical, multi-layered investigation into an acquisition target to uncover hidden risks or liabilities.

3PLR’s supply chain logistics due diligence addresses critical topics, such as:

Operational & Structural Considerations

- Operational Fitness: If the target has the processes, people, and IT systems to drive day-to-day operations efficiently and sustainably.

- Cost Synergies: If the transaction creates value beyond the companies’ standalone performance, such as cost savings from efficiencies and overlapping functions, customer integration, and economies of scale.

- Structural Integration: How to combine assets in an optimal way to create synergies, such as value-added services and distribution facilities, transportation modes and assets, and enabling executional IT systems and technology.

- Capital Expenditures: If structural gaps necessitate future investment in infrastructure, equipment, and facilities.

- Contract Implications: How existing contracts and terms may impact customer retention, pricing flexibility, and financial obligations.

Strategic & Commercial Considerations

- Strategic Fit: How the target’s business model enhances the acquirer’s existing product or service portfolio, capabilities, and markets.

- Expansion Potential: How the acquisition helps to achieve strategic goals, such as expanding into new customers and markets, adding service capabilities and products, and acquiring new technology.

- Competitive Impact: If the deal strengthens competitive advantage, increases market share, and generates efficiencies.

- Organization & Culture: How to mesh with target’s organization structure and management culture.

- Financial Discovery: If the there are hidden costs and required investments affecting valuation and revenue stability.

- Profitability & Growth: If historical performance is a reliable indicator of future profitability and market growth.

Approach: Comprehensive assessment of operational capabilities, costs & competitiveness

3PLR conducts supply chain logistics due diligence looking beyond financial statements to understand the acquisition target’s supply chain logistics capabilities and capacities, and sources of competitive advantage.

Discovery involves reviews of confidential information memorandum, management interviews, data collection and analysis, key site visits, and research covering topics such as . . .

- Company overview and growth strategy

- Current supply chain logistics strategy

- Organizational structure and affiliations

- Sales channels and customer industries

- Financial and customer results

- Facility locations and network design

- Process/IT review of key facilities (tours)

- Warehouse operations and facility layout

- Inventory deployment and optimization

- Domestic and international transportation

- Logistics IT systems and technology

- Operational KPIs and continuous improvement

Deliverable: Holistic view to operational capabilities, risks, growth potential, and integration challenges

In an M&A supply chain logistics operational due diligence project, the deliverables includes a comprehensive report that identifies potential risks, validates operational capabilities, and provides insight for integration and value capture.

- Executive summary: A comprehensive overview of the target company’s operational strengths, weaknesses, opportunities, and risks, as well as a concise view on the viability of the supply chain, and it’s fit with the acquiring company.

Synergy and value creation analysis: This deliverable quantifies potential cost savings and other value-adding opportunities achievable by integrating the target’s supply chain. - Operational risk assessment report: It details identified risks in the target’s supply chain logistics processes. It categorizes risks by potential impact on cost, revenue, and operational continuity and includes mitigation strategies.

- Quality of operations analysis: This deliverable assesses the overall operational effectiveness of the target company. It examines the quality of its processes, management, and technology infrastructure to identify performance gaps and improvement areas that impact the business valuation.

- Facility and asset assessment: For manufacturing or distribution-heavy acquisitions, this report includes a physical assessment of the target’s facilities, equipment, and assets. It details the condition of these assets, required capital expenditures, and potential utilization or capacity issues.

- Inventory and working capital: This analysis provides a clear picture of the target’s inventory health and management practices and working capital impact.

- Technology and systems integration: This report evaluates the target’s IT systems for supply chain and logistics execution, such as warehouse management systems (WMS) and transportation management systems (TMS), and integration with ERP and marketplaces.

Ready to optimize your strategy?

Contact 3PLR or schedule a call to discuss your company’s needs and find the right solution to optimize your operations.

Case Studies

M&A Operational Due Diligence | Case Study 1

M&A Operational Due Diligence, LTL Trucking – A $15B freight division of a global logistics services company sought assistance to evaluate an acquisition target, a $57M Less-Than-Truckload (LTL) US carrier.

M&A Operational Due Diligence | Case Study 2

Operations Due Diligence for Investment – A $1B mezzanine funding firm sought expert 3PL industry advice on a potential investment to fund a merger of a $300M European value-added warehousing and distribution business serving the high-tech consumer electronics industry.